Strategic Considerations in the Blairgowrie Hairdresser Market – Part 2

If you know where you sit in the marketplace and can think strategically about it, you are better able to develop winning strategies. This sounds straightforward, but the competitive risks and challenges of different positions are often under-appreciated.

Part 1 of this article reviewed the relationship between market share and profitability. In Part 2, I explore more of the implications and potential strategies of different market share positions. I use the example of hairdressers in Blairgowrie to illustrate.

Market Types

Note that there are two different types of markets, and the following discussion relates primarily to the first.

Relatively Fixed Market

If the market has a relatively fixed size (such as the Blairgowrie Hairdresser Market), there’s only so much to go around, and any new entrant has to take a slice of the pie from existing players.

Here strategies need to be about competitors and your comparative offer, as the market itself is not growing. Strategies such as a new product in an existing category, redesigning the business value chain, or consolidation/aquisition are typical.

Evolving Markets

In new or expanding markets experiencing high growth rates, market share positions are less relevant. Increased levels of activity and promotion will create more business, further expanding the market. Strategies here need to be focused on introducing new users rather than trying to win them from competitors.

Market Definition (& Size)

Your market share depends on how you define your market.

As a younger man I was trained in sales and marketing at Honeywell. Our regular sales reporting and forecasting relied on 3 market dimensions (TAM/FAM & SAM):

- Total Available Market – for the Blairgowrie hairdressers this means the entire hairdressing market of Scotland (or UK if so desired, which would raise a series of further implications).

- Forecast Available Market – which is the market in which we compete? For our hairdressers in this example it would be the regional Blairgowrie market. It could be defined more narrowly – say salons in Blairgowrie.

- Share of Available Market – how much is our share of FAM for each hairdresser?

The Blairgowrie Hairdressing Marketplace

The following rudimentary consideration of the hairdressing market in Blairgowrie illustrates the important issues around market definition and how it can drive strategic thinking.

My wife’s need for a hairdresser and our research identified 7 hairdressers in Blairgowrie.

The Monopoly Scenario

Imagine that one of these 7 was much larger than the others, and accounted for more than 70% of all hairdressing revenues. This business is able to outspend smaller competitors on promotions, discounts and special offers, recruit the best staff and train them in the latest styles etc. Its premises are likely to look more attractive and enticing than others, and most of the women in town would not want be seen in any other establishment.

But it must continually work hard to maintain this position, as others are constantly challenging. Any complacency or slippage in standards will see it begin to lose clients, and once this starts it is more likely to accelerate than reverse.

There are other strategic weaknesses and risks involved here as well. There are diseconomies of scale, with the need to service small or uneconomic segments as well mainstream business, and a tendency towards complacency which combine to produce an often inefficient use of assets and lower return on capital.

A monopoly also carries life-threatening risks – being an attraction to big (often international) competitors and the danger of regulatory intervention to remove monopolistic status.

The primary strategy here is to protect the current business, with a focus on efficiency and profits whilst reducing the risk of new entrants. Growth will only come for expansion into new markets, such as opening another outlet in a neighbouring town (Pitlochry?).

The Oligopoly Scenario

What if there were 3 main hairdressers, each with a relative share of more than 25%. Each will have a fairly steady clientele and while comparative positions may change over time, it is more likely to be evolutionary as full-scale competition is difficult to justify. Competitor reactions will blunt the advantages sought and any additional business won is unlikely to cover the additional overhead of marketing and promotion, impact of price discounting and the like.

This is a good place to be. The business has economies of scale in purchasing, processing or marketing and has segmentation strength, where it can dominate chosen segments with product groups, customer type, geographic area or other. Players in this situation tend to be price leaders and this is really the only market share position where cost-based strategies can be implemented to boost profitability.

Strategies should be focussed on cost reduction, with dominance in selected segments improving price-based margins. Additional growth can be sought through merger/acquisition or geographic expansion. Our hairdressers should also be keeping an eye on industry trends and product/service improvements or business efficiencies to avoid unexpected competition or a shifting industry dynamic.

The Mid-Sized Scenario

What if there are 1 or 2 larger hairdressers who dominate the market and a number of smaller, niche style businesses, but you are stuck in the middle – too small to control the market, and too big to be a niche player – you are constantly challenged from both above and below. This is no-man’s land and has a limited future.

There are insufficient economies of scale in either buying or selling and the firm has to be a price taker and is beaten on cost or price by the dominant firms and on service or features by the niche specialists. In the middle ground enterprises have an inadequate identity and little consumer support. There is no long-term basis for success and firms in this situation are continually under threat.

Larger players will challenge you if you start to grow too big, as they protect their position. The journey from 10% to 20% is generally the hardest.

Smaller players will identify specific niches and service them with highly targeted offers, thereby eroding your own market base.

Suitable strategies here revolve around business definition – you either have to get bigger or focus on smaller niches. A stagnant approach will likely lead to a slow death. To become larger, it is likely that considerable investment over time is needed – in promotion, salon upgrades, staff training and the like. All of which is likely to be fiercely opposed. Consideration could also be given to consolidation.

Alternatively, the business can be redefined into a smaller niche/s which allows a position of dominance. This may include the development of multiple niches and geographic duplication/expansion of these niches.

Some of the more common methods of developing niches include geographic segmentation (adjoining towns, town outskirts etc), service specialisation (colouring/combination hair & nails etc), or repackaging of services (mobile service to outlying properties, annual membership with 15 cuts/colours paid on a monthly basis).

The Niche Player Scenario

Where you have less than 5% of the market you are either a niche player, a new and growing business or just not very relevant. If your offer is just the same as everyone else, and you have no distinctive clientele, then you are just small and have a limited future.

The strategy in this scenario is to identify a niche and redefine the services you provide to give customers better value more closely aligned to their needs and wants. For example, a long-established hairdresser with an ageing clientele doesn’t need to invest in expensive and fancy shop fit-outs to look young and trendy – in fact quite the opposite. Nor do they need to train in the latest styles, just keep up with what the older clientele expects. This allows prices to be kept down and client loyalty is assured. The business might slowly be dying along with its customers, but it can be a very profitable place to be.

Alternatively, you may offer in-home services only. With virtually no overhead other than product, you can expect better margins, albeit in a restricted market.

Niche businesses are another good place to be – many consider it to be the best. Specialisation means an enterprise can choose one segment and own it, meaning something to someone. Safety lies in the fact that the niche is usually too small for larger, dominant firms to fight over. The added service or features that win customer support allows enterprises in this position to be profitable, sometimes to the point of being sinful, as it is removed from mainstream competition.

On the other hand – market share of less than 5% without a niche specialization is not a good place to be – as it simply means that nobody cares. In this case it is only a matter of time before the going gets too tough.

Strategies therefore revolve around identifying and fully servicing a defined niche (becoming a dominant player in a more closely defined market). Larger businesses can arise by in turn replicating this in other territories.

Conclusion

This is not intended to be a strategic review of business possibilities in the Blairgowrie hairdressing market, but is a useful analysis to demonstrate how market definition and market share are important determinants of successful strategy. A badly thought out strategy which ignores these realities may fail if it doesn’t recognise the nature and extent of probable competitor response.

Any strategy needs to be defendable if it is to provide long term results – and that’s the whole point!

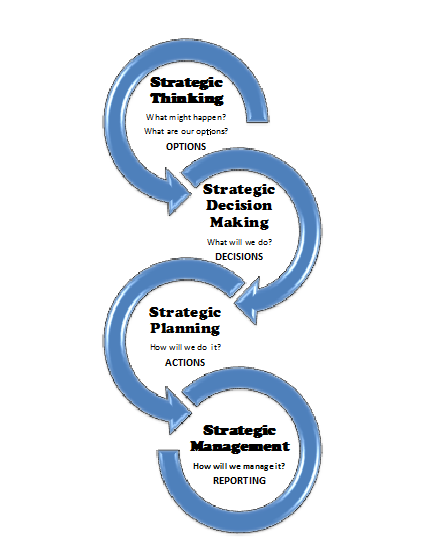

Strategic planning is what happens between thinking and execution.

Strategic planning is what happens between thinking and execution.