Improving financial capacity and structure strengthens business outcomes. We review and recommend suitable structures and assist in implementation.

The initial task is to assess current issues and business risk. This is done in the context of market and competitive position, industry trends and an assessment of business potential.

Detailed financial analysis includes:

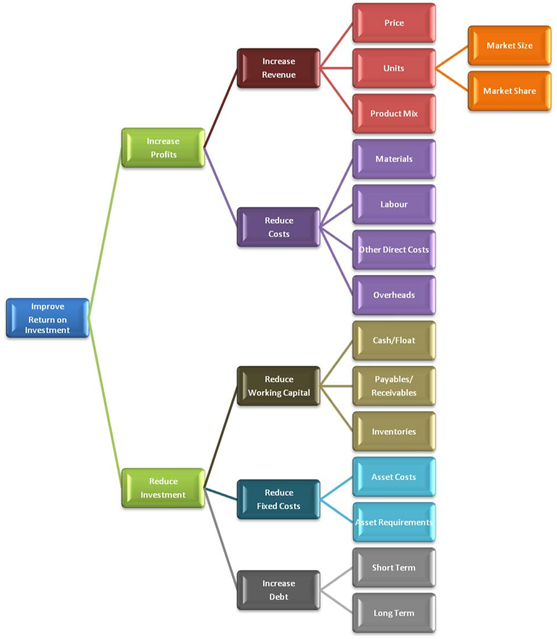

- Profitability – potential to improve returns;

- Cash flow and source of funds;

- Debt and gearing levels;

- Future cash/capital needs.

These are then set against potential change strategies, such as:

- Merger& acquisition/divestiture strategy;

- Potential for capital restructuring;

- Operational review.

Our objective is firstly to improve current operations, and then to assess the potential for a capital restructure that will provide a more secure footing for future operations. Once a plan has been established, we will introduce suitable finance professionals to negotiate new or alternative capital arrangements.